HTML

Styling

CSS

Migrainezorg zonder gezondheidsverzekering

Een persoonlijk budget maken en uitgaven bijhouden

Uw uitgavenpatroon begrijpen

Het analyseren van uw huidige uitgavenpatroon is essentieel voor het maken van een persoonlijk budget. Dit houdt in dat u elke uitgave nauwkeurig bijhoudt, of het nu gaat om boodschappen, entertainment, vervoer of terugkerende rekeningen.

Read more about Migrainezorg zonder gezondheidsverzekering

Vitamine D-spiegels en de frequentie van migraine: Is er een verband?

May 10, 2025

Hoe een ontspannende avondroutine te creëren voor een betere nachtrust

May 19, 2025

Muziektherapie voor ontspanning en pijnmanagement

May 29, 2025

Gebruik van kennis over triggers om je leven te verbeteren

May 31, 2025

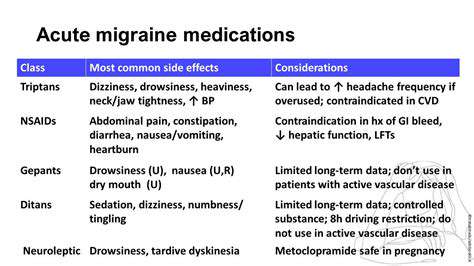

Is het veilig om migrainemedicatie langdurig in te nemen?

Jun 05, 2025

Wat veroorzaakt hoofdpijn echt? De wetenschap verkennen

Jun 10, 2025

De rol van patiëntenadvocatenorganisaties bij het bewustzijn van migraine

Jul 05, 2025

Barometrische drukhoofdpijn: Feit of fictie?

Jul 08, 2025

Combinatie van acute en preventieve migrainetherapieën

Jul 08, 2025

Stress en hoofdpijn: het belangrijkste trigger beheren

Jul 10, 2025

Bardina en Kamille: Kruidenmiddelen voor hoofdpijn

Jul 20, 2025