HTML

Styling

CSS

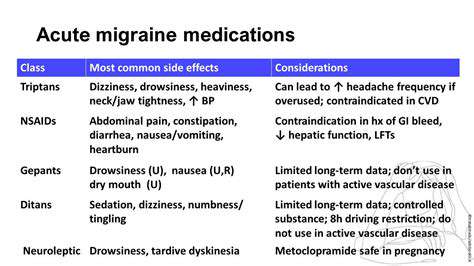

Quản lý chăm sóc đau nửa đầu mà không có bảo hiểm sức khỏe

Tạo ngân sách cá nhân và theo dõi chi tiêu

Hiểu thói quen chi tiêu của bạn

Phân tích thói quen chi tiêu hiện tại của bạn là rất quan trọng để tạo ra một ngân sách cá nhân. Điều này bao gồm việc theo dõi kỹ lưỡng mọi khoản chi tiêu, cho dù là thực phẩm, giải trí, vận chuyển hay hóa đơn định kỳ

Read more about Quản lý chăm sóc đau nửa đầu mà không có bảo hiểm sức khỏe

Mức vitamin D và tần suất đau nửa đầu: Có mối liên hệ không?

May 10, 2025

Cách tạo thói quen thư giãn trước khi ngủ để ngủ ngon hơn

May 19, 2025

Sử dụng liệu pháp âm nhạc để thư giãn và quản lý đau

May 29, 2025

Sử dụng kiến thức về các yếu tố kích hoạt để cải thiện cuộc sống của bạn

May 31, 2025

Có an toàn khi dùng thuốc đau nửa đầu trong thời gian dài không?

Jun 05, 2025

Trẻ em có thể vượt qua chứng đau đầu dữ dội không?

Jun 08, 2025

Nguyên nhân thực sự của chứng đau nửa đầu là gì? Khám phá khoa học

Jun 10, 2025

Vai trò của các nhóm vận động vì bệnh nhân trong việc nâng cao nhận thức về chứng đau đầu丛集

Jul 05, 2025

Đau đầu do áp suất khí quyển: Sự thật hay hư cấu?

Jul 08, 2025

Kết hợp liệu pháp cấp tính và phòng ngừa đau nửa đầu

Jul 08, 2025

Stress và Đau Đầu: Quản lý Nguyên Nhân Kích Hoạt Số Một

Jul 10, 2025

Bồ công anh và Hoa cúc: Thuốc thảo dược trị đau đầu

Jul 20, 2025