Understanding the Financial Assistance Programs for Migraine Medications

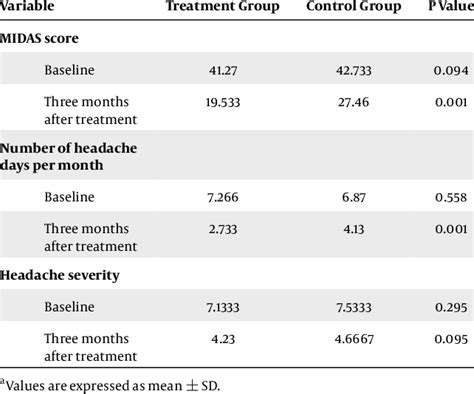

Different Types of Financial Assistance

Government Grants

Government grants are a type of financial assistance offered by the government to individuals and organizations for specific purposes. These grants are typically awarded based on demonstrated need, merit, or the pursuit of public interest goals. They often come with specific eligibility requirements and conditions, and recipients may be expected to contribute to the project or program in some way. Different levels of government, from local to national, offer various grant programs, targeting diverse needs and sectors, such as education, healthcare, environmental protection, and community development.

A key characteristic of government grants is that they are typically not required to be repaid. This makes them a valuable resource for those seeking to further education, start businesses, or address pressing community needs. However, grants often have strict guidelines and reporting requirements, ensuring the funds are used as intended and the program's objectives are met.

Private Grants and Philanthropy

Private grants and philanthropic contributions represent another significant source of financial assistance, stemming from private individuals, foundations, or corporations. These organizations often focus on specific areas of interest, such as arts, education, or environmental conservation. They may have particular criteria for selecting recipients, focusing on initiatives that align with their values and strategic goals. These grants can be highly competitive and often require detailed proposals demonstrating a clear understanding of the project's goals and impact.

Private donors and foundations may also provide funding for research, development, and innovation. Their involvement often reflects a commitment to societal advancement and addresses specific challenges in a targeted manner. The motivations behind these contributions vary, ranging from charitable giving to the pursuit of personal or professional goals.

Loans and Financing Options

Loans and financing options, unlike grants, typically require repayment. These can take various forms, including student loans, small business loans, and personal loans. They provide access to capital for individuals and organizations to pursue various goals, including education, starting a business, or making significant purchases. The terms of the loan, including interest rates, repayment schedules, and collateral requirements, vary significantly depending on the lender and the borrower's circumstances. Careful consideration of repayment capacity is crucial when considering loan options.

Access to affordable loans and financing options can significantly impact an individual or organization's ability to achieve its financial goals. Understanding the different types of loans available, their associated costs, and the terms and conditions is essential to making informed decisions. Factors like credit score, income, and the purpose of the loan will influence the terms and conditions offered by lenders.

Eligibility Criteria and Application Processes

Eligibility Criteria for Financial Assistance

Applicants seeking financial assistance must meet specific criteria to be considered. These criteria typically include demonstrating financial need, such as low-to-moderate income, and/or meeting specific academic or program requirements. Documentation of income, expenses, and assets is often required to substantiate the applicant's financial circumstances. Failure to meet these eligibility requirements may result in the application being denied.

Furthermore, specific academic standing, such as maintaining a certain GPA or enrollment status, might also be considered. The criteria for eligibility can vary significantly depending on the particular financial assistance program or institution offering the aid. Understanding these specific criteria is crucial for applicants to ensure their application is complete and accurate.

Application Process Overview

The application process for financial assistance typically involves several steps, from gathering required documents to submitting the completed application form. Applicants should carefully review the instructions provided by the financial aid office to ensure they understand the entire process. Detailed instructions regarding the necessary documents, deadlines, and submission methods are essential for successful application completion.

Completing the application form accurately and thoroughly is critical, as any errors or omissions could delay or even prevent the application from being processed. Applicants should also be aware of any specific requirements for supporting documentation, such as tax returns or bank statements, and ensure these are submitted in a timely manner.

Required Documents for Application

A comprehensive list of required documents is crucial for a successful application. These documents typically include proof of identity, such as a government-issued ID or passport. Financial documents, such as tax returns, pay stubs, and bank statements, are often required to demonstrate financial need and accurately assess eligibility. Accurate records of any other relevant financial information or assets should be included, as well.

Documentation of academic standing, such as transcripts or enrollment verification, may also be required. It's essential to carefully review the specific document requirements outlined by the program or institution providing the financial assistance, as these requirements can vary.

Application Deadlines and Submission Methods

Understanding the application deadlines is crucial for timely submission. Deadlines are often specific to each financial aid program, and missing the deadline may result in the application being rejected. Applicants should carefully review the deadlines provided by the financial aid office and plan accordingly.

The method of submission may vary, encompassing online portals, physical mail, or email submissions. Applicants must adhere to the specified method of submission to ensure their application is received and processed properly. This process is crucial and should be followed precisely.

Appeals and Contact Information

In situations where an applicant is dissatisfied with the decision regarding their application, understanding the appeals process is essential. The financial aid office typically outlines a procedure for appealing a denied application. This procedure should be carefully reviewed, as timelines and specific requirements for appealing may exist.

Contact information for the financial aid office is crucial for clarifying any questions or concerns throughout the application process. Having this readily available information allows for timely communication and resolution of any issues that may arise. Understanding these aspects is critical to a smooth and successful experience.

Finding and Applying for Programs

Understanding Program Requirements

A crucial first step in finding and applying for programs is a thorough understanding of the specific requirements. This involves not only identifying the necessary qualifications, such as academic transcripts, test scores, or prior experience, but also critically evaluating the program's goals and objectives. Understanding these nuances will help you determine if the program aligns with your personal and professional aspirations. Furthermore, understanding the program's application process, deadlines, and submission guidelines is vital to avoid common application errors.

Careful review of the program's curriculum and faculty expertise will also provide valuable insight. This helps you determine if the program's content and faculty align with your learning style and professional interests. This detailed understanding ensures you're making an informed decision about your application and maximizing your chances of success.

Identifying Relevant Programs

Once you've clarified your needs and goals, the next stage involves actively searching for programs that align with your interests. This could involve exploring university websites, online program directories, or contacting program coordinators directly. It's essential to research different options, comparing program structures, faculty expertise, and potential career outcomes.

Crafting a Compelling Application

A strong application is more than just a collection of documents; it's a carefully crafted narrative that showcases your unique skills and experiences. This requires meticulous attention to detail, ensuring the application materials are accurate, well-written, and demonstrate a deep understanding of the program. Thorough preparation is key to creating a compelling narrative that effectively communicates your value to the program's admissions committee. Carefully constructed essays, letters of recommendation, and personal statements are all crucial components.

Preparing Supporting Documents

Gathering all necessary supporting documents, such as transcripts, letters of recommendation, and standardized test scores, is a critical step in the application process. These documents provide concrete evidence of your qualifications and capabilities, which is essential for demonstrating your suitability to the program. Ensure that all documents are properly formatted, reviewed for accuracy, and submitted by the specified deadlines.

Managing Deadlines Effectively

Application deadlines are often tight, and missing them can result in disqualification. Effective time management is crucial. Creating a realistic timeline for each step of the application process, from research to submission, is essential to avoid last-minute stress and ensure a smooth application journey. Efficient planning and a well-organized approach to managing deadlines will greatly reduce the likelihood of errors and will help you meet each deadline successfully.

Exploring Financial Aid Opportunities

Many programs offer financial aid options, including scholarships, grants, and loans. It's important to research these opportunities thoroughly, as they can significantly reduce the financial burden of pursuing education. Exploring and understanding these options can greatly ease the financial strain on students and help them pursue their educational goals. This involves contacting the financial aid office of the program and researching various funding sources.

Seeking Mentorship and Guidance

Seeking mentorship and guidance from experienced professionals or current students in the field can provide invaluable insights into the application process and the program itself. This external support can significantly enhance your understanding of the process and provide invaluable guidance, leading to a more successful application. Learning from the experiences of others can help you navigate the process more effectively.

Important Considerations

Eligibility Criteria

Determining eligibility for financial assistance programs often involves a multifaceted evaluation of individual circumstances. This evaluation typically considers factors such as income levels, immigration status, length of residency in the country, family size, and existing financial resources. Understanding the specific criteria for each program is crucial, as they can vary significantly depending on the program's goals and the needs it aims to address. Different programs may place different weights on these factors, and applicants should carefully review the specific guidelines provided by the program administrators.

Applicants should thoroughly research the eligibility requirements before applying. This diligence will save time and frustration, as incorrect applications may be rejected due to unmet criteria. Seeking guidance from qualified advisors or program representatives can provide valuable clarification on the requirements and assist applicants in navigating the complexities of the application process. It's essential to be proactive in gathering all necessary documentation to support your application and demonstrate compliance with the eligibility standards.

Application Process and Deadlines

Navigating the application process for financial assistance programs requires meticulous attention to detail and adherence to established procedures. Applicants should carefully review the application forms, ensuring that all required information is accurately and completely provided. Failure to comply with the program's specific instructions or to provide necessary supporting documents can lead to application rejection. Understanding the application process, including the required documentation and deadlines, is essential for successful application and timely processing.

Deadlines for applications are critical to the timely processing of requests. Missing deadlines can result in the application being deemed ineligible. Therefore, it is essential to carefully monitor the deadlines and ensure that all required documents are submitted well before the specified date. Being proactive and aware of deadlines will help avoid delays and potential rejection.

Types of Assistance Available

Financial assistance programs for migrants often encompass a range of support options tailored to address diverse needs. These programs may include grants, loans, scholarships, or other forms of financial aid. Understanding the different types of assistance available is crucial in identifying the most suitable option for individual circumstances. Some programs may focus on educational opportunities, while others may provide support for housing, healthcare, or job training.

Researching and understanding the specific services each program offers is essential to ensure that the program aligns with the recipient's individual needs and goals. By carefully comparing the offerings of various programs, individuals can make informed decisions about which program will provide the most effective and relevant support.

Important Considerations Regarding Documentation

Accurate and complete documentation is essential for a successful application to any financial assistance program. This includes providing evidence of immigration status, proof of residency, financial records, and any other supporting documents requested by the program. The validity and authenticity of the presented documents are crucial for the program to assess the applicant's eligibility accurately.

Ensuring that all documents are properly formatted, certified, and translated when necessary is critical. It's advisable to consult with program representatives to understand the specific requirements for document submission. Carefully reviewing the program's guidelines regarding documentation requirements before initiating the application process will significantly contribute to a smoother and more efficient application process.